Table of Content

- Option Greek Explained

- Delta

- Gamma

- Theta

- Vega

- Rho

- Why Are Greeks Important?

- Practical Application of the Greeks

- Conclusion

- Frequently Asked Questions

Option Greek Explained: Theta Delta Gamma Vega Rho

In options trading, the term "Greeks" signifies a group of metrics that assist traders in understanding how different factors can impact an option's price. As such, the Greeks are useful tools for enhancing your decision-making in options trading. Let's explain the most important Options Greeks in a way that is easy to understand.

Delta

Delta measures how much an option’s price is expected to change when the price of the underlying asset changes by Rs 1. For example, if you have a call option with a delta of 0.5, it means that if the stock price increases by RS 1, the price of your option is likely to increase by Rs 0.50.

Range:-

Delta value in Greek option ranges from 0 to 1 for call option and delta value from -1 to 0 for put option.

Explanation:-

A high delta indicates that the option's price is going to be much more responsive to changes in the prices of the underlying asset. For instance, deep in-the-money options have a delta closer to 1, while out-of-the-money options have a delta closer to 0.

Gamma

Gamma is a measure of how much the option's delta value has changed. While delta tells you how much an option’s price will move with a Rs 1 change in the underlying asset, gamma tells you how much delta will change as the underlying asset moves.

Importance

High gamma means that delta can change significantly with small movements in the stock or index price. This is particularly important for traders who are managing their positions closely.

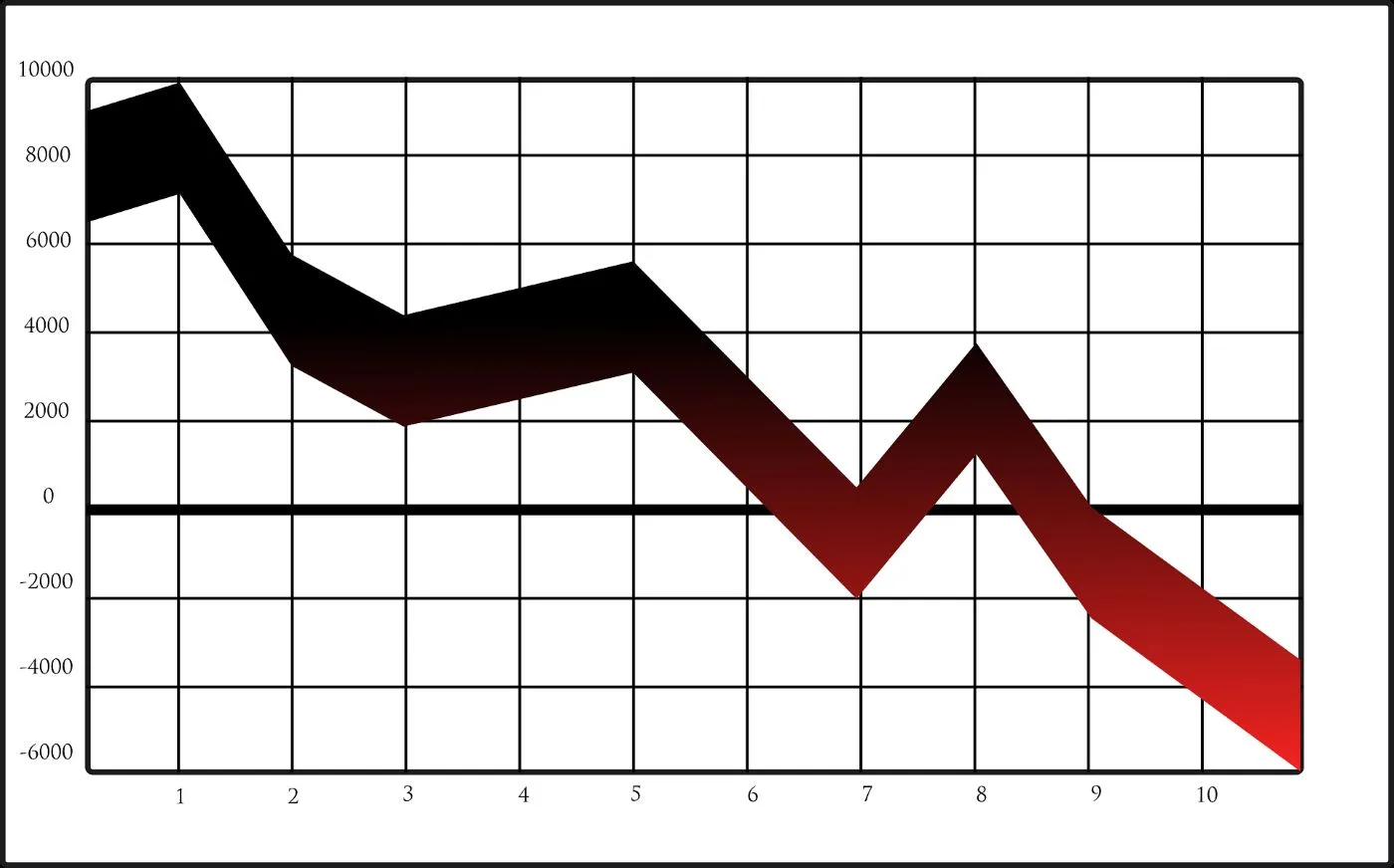

Theta

Theta indicates how much the price of an option declines as it gets closer to its expiration date, a phenomenon referred to as time decay. Options are wasting assets, which means their value decreases over time if everything else stays the same price.

Understanding Time Decay

For example, if an option has a theta of -0.05, it means the option will lose about 0.05 in value each day as it approaches expiration. This is a good thing for option sellers and a profitable for them.

Vega

Vega measures how much an option’s price changes in response to a 1% change in the implied volatility (IV) of the underlying asset. Implied volatility or IV is the market’s expectations for future price movements.

High Vega:-

If you have an option price with a Vega of 0.2, a 1% rise in implied volatility could lead to a 0.20 increase in the option’s price. Options are often more valuable when volatility is high, as there’s a greater chance of large price movements.

Rho

Rho evaluates how an option's price reacts to changes in interest rates. It indicates how much the price of an option is expected to change when interest rates rise by 1%.

Interest Rates Impact

If a call option has a rho of 0.1, this indicates that a 1% increase in interest rates would lead to a 0.10 increase in the price of the option. While rho is less commonly considered than the other Greeks, it can still play a role in long-term options.

Why Are Greeks Important?

Understanding the Greeks is important for anyone looking to trade options successfully. They help traders navigate risk and make smart decisions about when to enter and exit their trades position.

Risk Management

By understanding delta and gamma, traders can measure their exposure to price movements and adjust their positions accordingly.

Strategy Development

Theta is important for options sellers who want to take advantage of time decay, while Vega is important for traders who look to profit from changes in volatility.

Market Conditions

Rho helps traders consider the effects of changing interest rates on their options strategies.

Practical Application of the Greeks

Delta Hedging

Imagine you have 100 shares of a stock and you've sold a call option for it. If that call option has a delta of 0.6, you might consider buying 60 shares of the underlying stock. This strategy can help protect you from potential losses if the stock price goes up.

Managing Time Decay

If you hold options close to expiration, you’ll want to be aware of theta. Knowing that time decay will accelerate can help you decide whether to close your position or roll it over to a later expiration.

Trading Volatility

If you believe that volatility is about to increase, you might look for options with high Vega. Buying those options could be a profitable strategy.

Conclusion

Option Greeks are important tools that every options trader should understand. Delta, gamma, theta, Vega, and rho each provide unique insights into how options are priced and how they will react to various market conditions. Whether you're a beginner or aiming to enhance your trading skills... and also check our Disclaimer page.

Frequently Asked Questions

What are the 5 Greeks in options?

The five Greeks in options are Delta, Gamma, Theta, Vega and Rho.

Is low theta good?

Low theta options are good for buyers but not so profitable for option sellers.

What are the best Greeks for options?

The best Greeks for options depend on your technique; High delta and gamma are good for short-term moves, and low theta is ideal for long-term holdings. Vega is important for volatility and Rho is important for interest rate changes.